does florida charge capital gains tax

This also means that there are also no Florida capital gains taxes. Short-term gains are taxed as ordinary income based on your personal income tax bracket.

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Income taxes are one major way government.

. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. But if you live in Florida youll be responsible for paying federal capital gains tax when you sell your. The state of FL has no income tax at all -- ordinary or capital gains.

Capital Gains Tax Rate. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Does Florida Have Capital Gains Tax. Florida Capital Gains Tax.

There are only nine states without capital gains taxes. Individuals and families must pay the following capital gains taxes. What is the capital gains tax rate for 2021 in Florida.

No there is no Florida capital gains tax. They are Washington Nevada Texas Wyoming South Dakota Tennessee Florida Alaska and New Hampshire. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

In Florida you are required to pay documentary stamp taxes on the transfer of real estate for any consideration including the amount of any mortgage on the property. Florida does not impose a state income tax on its citizens so there is no taxation on capital gains on precious metals. 52 rows AK FL NV NH SD TN TX WA and WY have no state capital gains tax.

There is currently no Florida income tax for individuals and therefore no Florida capital gains tax for individuals. If you earn money from investments youll still be subject to the federal capital. Oil just fell to 98barrel.

If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes to the. In 2007 98 was the all time high and gas averaged 263gallon. The State of Florida does not have an income tax for individuals and.

You have lived in the home as your. Does Florida Have a Capital Gains Tax. Florida Department of Revenue.

Make sure you account for the way this. AL AR DE HI IN IA KY MD MO MT NJ NM NY ND OR OH PA SC and WI either allow taxpayer to deduct. Florida is one of nine states with no personal state income tax.

How can the oil be the exact same price it was but the gas costs three times as much. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term capital gains. Capital Gains Tax Rate Currently Floridas business tax rate is 55 percent with exemptions for passthrough entities.

If your taxable income is less than 80000 some or all. The State Of Florida Does Not Have An Income Tax For Individuals And Therefore No Capital Gains Tax For Individuals. Florida has no state income tax which means there is also no capital gains tax at the state level.

After federal capital gains taxes are reported through IRS Form 1040 state taxes may. Individuals and families must pay the following capital gains taxes. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term capital gains.

The Capital Gains Tax Is Risky Business Daniel J Mitchell Capital Gains Tax Capital Gain Risky Business

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

The Major Distinction Between Condo Vs Co Op Is Exactly What You Will Actually End Up Owning A Co Op Owner Does Not Own The Unit House Hunters The Unit Condo

7 Credit Card Rules You Can Break In An Emergency Credit Card Cash Advance Credit Card Credit Card Charges

A List Of Some Of The Taxes We Pay Federal Income Tax Indirect Tax Tax Services

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attractive Business Tax Deductions Small Business Tax Business Tax

Afbeeldingsresultaat Voor Gif Rutte Cartoon Money And Happiness Paying Off Mortgage Faster Mortgage Payoff

Why Tax Loss Harvesting During Down Markets Isn T Always A Good Idea Advicers Taxlossharvesting Marketdownturn In 2022 Capital Gains Tax Tax Brackets Investing

Wilderness Culture On Instagram Overlooking Pea Soup Lake Washington Photo Jeffreymichaelcarls Washington Travel Washington State Travel Places To Travel

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Miami Vice Florida Structured Settlement Lawyer Charged With 14 Felony Counts Of Fraud Forgery Structured Settlements Hoverboard Music Coloring

Vrbo Or Home Away Versus Airbnb Genymoney Ca Personal Finance Bloggers Money Saving Mom Personal Finance Lessons

The Membership Fee Is 99 Every Month Plus Any Additional Taxes And Surcharges Www Chasestyleclub Com Chasestyle Online Gambling Gambling How To Find Out

How To Reduce Errors At The Time Of Tax Preparation Tax Help Irs Taxes Income Tax Preparation

Here Is A New Rendering Of Riverwalk Place Tampa Now With More Residential Units And No Office Space The Project River Walk Office Space Architecture Design

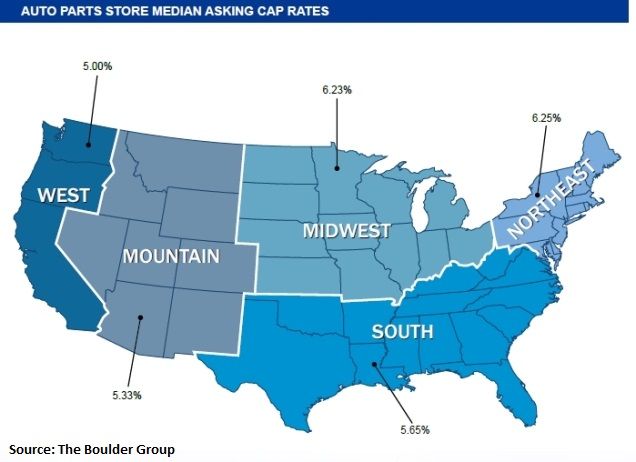

The Auto Parts Sector For The Purpose Of This Report Is Defined As Advance Auto Parts Autozone And O Reilly Auto Parts As They Account Lease Bouldering Net

Pin By Angela Mclain Real Estate On Homes Infographic Home Buying Find A Job